Introduction

Homeownership has long been seen as the ultimate symbol of the American dream, but is it really the best option for everyone? In recent years, there has been a growing trend towards renting, as people seek more flexibility and less responsibility.

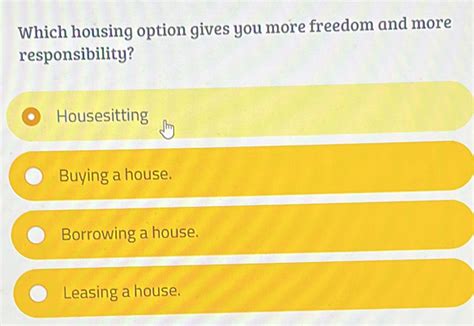

So, which housing option is right for you? It depends on your individual circumstances and preferences. If you value freedom and flexibility, then renting may be a better option. If you are looking for a long-term investment and are willing to take on more responsibility, then homeownership may be a better choice.

Renting

Renting offers a number of advantages over homeownership, including:

- Flexibility: Renters are not tied down to one location, so they can move more easily if they need to. This can be a major advantage for people who are starting out in their careers or who are not sure where they want to live long-term.

- Less responsibility: Renters do not have to worry about maintenance and repairs, which can be a major expense and hassle for homeowners.

- Lower upfront costs: Renting typically requires a lower upfront investment than buying a home, which can be a major advantage for people who do not have a lot of money saved.

Homeownership

Homeownership also has its advantages, including:

- Long-term investment: A home can be a valuable long-term investment, as it typically appreciates in value over time. This can be a great way to build wealth over time.

- Customization: Homeowners can customize their homes to their own preferences, which can be a major advantage for people who want to create a space that is uniquely their own.

- Tax benefits: Homeowners can deduct mortgage interest and property taxes on their federal income taxes, which can save them a significant amount of money.

Which Option Is Right for You?

Ultimately, the decision of whether to rent or buy is a personal one. There is no right or wrong answer, and the best option for you will depend on your individual circumstances and preferences.

If you value freedom and flexibility, then renting may be a better option. If you are looking for a long-term investment and are willing to take on more responsibility, then homeownership may be a better choice.

Here are some questions to ask yourself to help you make a decision:

- How long do you plan on staying in your current location?

- How much money do you have saved for a down payment?

- Are you willing to take on the responsibility of homeownership?

- What are your financial goals?

Financial Considerations

When it comes to housing, finances are a major consideration. Here is a comparison of the financial implications of renting versus buying:

| Financial Aspect | Renting | Buying |

|---|---|---|

| Upfront costs | Lower | Higher |

| Monthly costs | Typically lower | Typically higher |

| Long-term costs | Can be higher than buying | Can be lower than renting |

| Investment potential | None | Potential for appreciation |

| Tax benefits | None | Mortgage interest and property taxes are deductible |

Other Considerations

In addition to financial considerations, there are a number of other factors to consider when choosing between renting and buying, such as:

- Lifestyle: Do you prefer the flexibility of renting or the stability of homeownership?

- Location: Where do you want to live and what type of housing is available in that area?

- Personal preferences: What are your personal preferences in terms of housing size, amenities, and location?

Conclusion

The decision of whether to rent or buy is a personal one. There is no right or wrong answer, and the best option for you will depend on your individual circumstances and preferences. By carefully considering the factors discussed in this article, you can make an informed decision that is right for you.