As you navigate the complexities of applying for financial aid, it’s crucial to understand what factors are taken into account. One common concern among students is whether the Free Application for Federal Student Aid (FAFSA) considers debt when determining their eligibility for aid.

Types of Debt Considered by FAFSA

The FAFSA considers different types of debt, including:

- Parent PLUS Loans: These loans are taken out by parents to help cover their child’s educational expenses. The amount borrowed is included in the FAFSA calculation.

- Federal Student Loans: Any outstanding federal student loans, such as Direct Loans or Perkins Loans, are included on the FAFSA.

- Private Student Loans: Unlike federal loans, private student loans are not automatically considered in the FAFSA calculation. However, they may be reported on the FAFSA if the student chooses to do so.

Impact of Debt on FAFSA Eligibility

The inclusion of debt in the FAFSA can affect your eligibility for aid in several ways:

- Reduced Expected Family Contribution (EFC): The EFC is a calculation based on your financial information, including debt. A higher EFC means you are expected to contribute more towards your education, potentially reducing your eligibility for grants and scholarships.

- Increased Loan Amount: If you include private student loans on your FAFSA, it may increase the total loan amount used to determine your financial need. This could lead to higher monthly payments after graduation.

- Loan Repayment Deferment: If you have federal student loan debt, you may be eligible to defer your payments while you are in school. This can help reduce your financial burden during college.

Debt and Financial Independence

The FAFSA’s consideration of debt emphasizes the importance of financial independence. Students who can demonstrate that they are responsible borrowers and have limited debt will have a stronger case for increased financial aid eligibility. This reinforces the importance of carefully managing your finances and exploring alternative funding options.

Strategies for Minimizing Debt Impact

To mitigate the impact of debt on your FAFSA eligibility, consider the following strategies:

- Consolidate Loans: Combine multiple student loans into a single loan with a lower interest rate. This can reduce your monthly payments and potentially lower your EFC.

- Refinance Loans: Explore loan refinancing options to secure a lower interest rate. This can also reduce your EFC and increase your aid eligibility.

- Explore Forbearance or Deferment: If you are struggling to repay your student loans, consider applying for forbearance or deferment. This can temporarily pause your payments and prevent them from increasing your EFC.

- Seek Professional Advice: If you have significant debt, consider consulting with a financial advisor to develop a personalized debt management plan.

Conclusion

Understanding how FAFSA considers debt is crucial for optimizing your financial aid eligibility. While debt can impact your EFC and loan amount, it is important to remember that financial independence and responsible borrowing play a vital role in securing funding for your education. By carefully managing your debt and exploring alternative funding options, you can increase your chances of receiving the financial support you need to achieve your academic goals.

Frequently Asked Questions

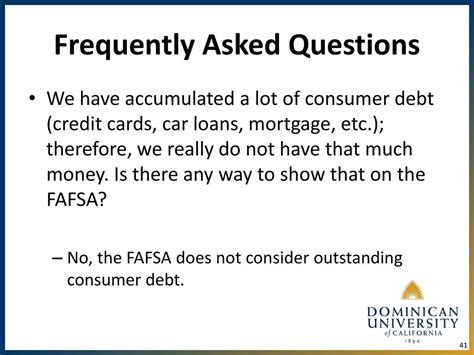

- Does my car loan affect my FAFSA eligibility? No, your car loan is not considered on the FAFSA unless you are using it as collateral for a private student loan.

- What happens if I have outstanding credit card debt? Credit card debt is not reported on the FAFSA. However, it can impact your overall financial health and potentially affect your ability to qualify for private student loans.

- How can I improve my FAFSA eligibility if I have debt? Consolidate or refinance your loans, consider forbearance or deferment, and seek professional advice to develop a strong debt management plan.

- Is it better to include private student loans on my FAFSA? It depends on your individual circumstances. If you have high-interest private loans, including them may increase your EFC and loan amount. However, if you have low-interest loans, it may be beneficial to report them to demonstrate your financial need.