Introduction

Planning for graduate school can be a daunting task, especially when it comes to financing your education. The 529 plan, a tax-advantaged savings plan, can be a valuable tool for saving for graduate school expenses. This guide will provide you with a comprehensive understanding of 529 plans, their benefits, and strategies for maximizing your savings.

Key Statistics

- Over $360 billion was saved in 529 plans in 2022.

- 529 plans have helped millions of families save for college and graduate school.

- The average 529 plan balance is $32,000.

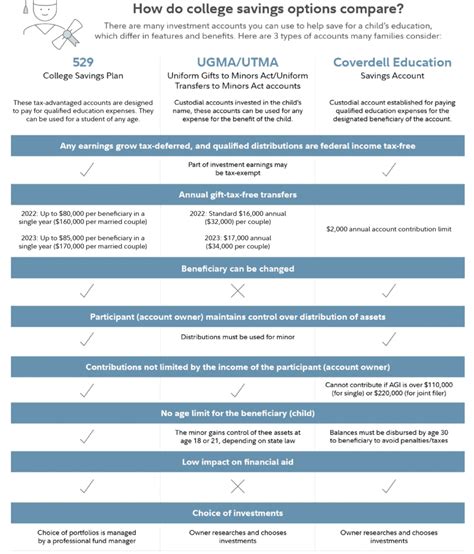

Benefits of 529 Plans

Tax Savings:

- Earnings on 529 plans grow tax-free.

- Withdrawals for qualified education expenses, including graduate school, are tax-free.

Flexibility:

- 529 plans offer a variety of investment options.

- Funds can be used at any accredited college or university.

- Withdrawals can be made for any qualified education expense, including tuition, fees, books, and living expenses.

Long-Term Savings:

- 529 plans have a long investment horizon, allowing for potential growth.

- Contributions can be made over a period of years, making it easier to save for graduate school.

Understanding 529 Plans

Types of 529 Plans:

- State-sponsored plans: Offered by individual states, these plans typically provide tax benefits for in-state residents.

- Private 529 plans: Offered by financial institutions, these plans have more investment options but may not offer the same tax benefits as state-sponsored plans.

Investment Options:

- Target-date funds: Invest in a mix of stocks and bonds based on the participant’s age and retirement date.

- Index funds: Track the performance of a specific market index, such as the S&P 500.

- Managed funds: Actively managed by a fund manager who makes investment decisions.

Strategies for Maximizing Savings

Contribute Early and Regularly:

- The earlier you start saving, the more time your money has to grow tax-free.

- Set up automatic contributions to ensure you are saving consistently.

Explore State-Sponsored Plans:

- Research the benefits of your state’s 529 plan.

- Some states offer tax deductions or matching contributions for in-state residents.

Choose the Right Investment Options:

- Consider your investment horizon and risk tolerance when selecting investments.

- Target-date funds can simplify the investment process for those with less experience.

Take Advantage of Tax Breaks:

- Federal and state income tax deductions or credits may be available for 529 plan contributions.

- Make sure to consult with a tax professional for specific details.

Conclusion

529 plans are a powerful tool for saving for graduate school. By understanding the benefits, types, and strategies involved, you can maximize your savings and make graduate school more affordable. Remember to start saving early, research your options, and consult with a financial advisor for personalized guidance. With careful planning, you can achieve your graduate school dreams while minimizing the financial burden.

Tips and Tricks

- Consider gifting 529 plan contributions to minimize the impact on your own income.

- Explore employer-sponsored 529 plans if available.

- Set up multiple 529 plans to diversify your investments and maximize potential growth.

- Use a 529 plan calculator to estimate how much you need to save and the potential growth of your investments.

Useful Tables

Table 1: Types of 529 Plans

| Plan Type | Benefits | Drawbacks |

|---|---|---|

| State-sponsored plans | Tax benefits for in-state residents | May have limited investment options |

| Private 529 plans | More investment options | May not offer the same tax benefits as state-sponsored plans |

Table 2: Investment Options for 529 Plans

| Investment Type | Features | Benefits | Drawbacks |

|---|---|---|---|

| Target-date funds | Diversify investments based on age | Simplify investment management | May not be customized |

| Index funds | Track market performance | Lower fees | No active management |

| Managed funds | Actively managed by fund managers | Potential for higher returns | Higher fees |

Table 3: Tax Benefits of 529 Plans

| Tax Benefit | Availability | Amount |

|---|---|---|

| Federal income tax deduction | Federal income tax return | Up to $10,000 per beneficiary per year |

| State income tax deduction or credit | Varies by state | Varies by state |

Table 4: Contributions and Withdrawals

| Contribution Limit | Withdrawal Limit |

|---|---|

| Varies by plan | No specific limit |

| Withdrawals for qualified education expenses are tax-free | Withdrawals for non-qualified expenses may be subject to taxes and penalties |