Navigating the complexities of the Colorado tax system can be a daunting task, especially when dealing with the 1104 form. This comprehensive guide aims to demystify this crucial document, empowering you to file your taxes accurately and efficiently.

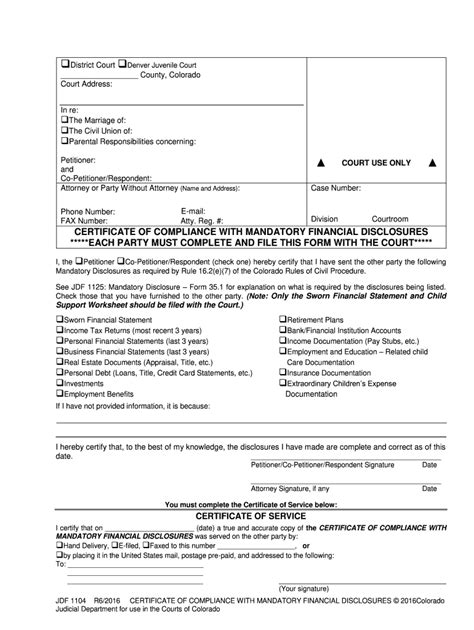

Understanding the 1104 Colorado Form

The 1104 Colorado Individual Income Tax Return is a document used to report your taxable income and calculate the amount of taxes you owe or will receive as a refund. It is similar to the federal Form 1040 but has specific provisions tailored to Colorado taxpayers.

Key Components of the 1104 Form

The 1104 form consists of several sections that gather information about various aspects of your financial situation, including:

Personal Information and Exemptions

- Name, address, Social Security number

- Filing status (single, married, head of household, etc.)

- Number of dependents

Income

- Wages, salaries, tips, and other compensation

- Business income

- Investment income

Deductions and Adjustments

- Standard deduction or itemized deductions

- Certain types of business expenses

- Retirement contributions

Credits

- Child tax credit

- Earned income tax credit

Other Information

- Estimated tax payments

- Unemployment benefits

- Self-employment tax

Common Mistakes to Avoid

To ensure accurate tax filing, be vigilant about avoiding these common pitfalls:

- Incorrect filing status: Choosing the wrong filing status can result in incorrect tax calculations.

- Missing or incorrect Social Security number: This information is essential for identifying you and processing your return.

- Math errors: Even small errors in calculations can lead to incorrect tax amounts.

- Overlooking deductions and credits: Failing to claim eligible deductions and credits can reduce your refund or increase your tax liability.

- Not filing on time: Missing the filing deadline can result in penalties and interest charges.

Pros and Cons of the 1104 Form

Pros:

- Provides a comprehensive overview of your financial situation

- Allows you to calculate and pay (or receive) your taxes accurately

- Supports Colorado state revenue and essential public services

Cons:

- Can be complex and time-consuming to complete, especially for individuals with complex financial situations.

- Requires gathering and organizing a significant amount of documentation.

- Subject to changes in tax laws and regulations, which can impact your tax liability.

Using the 1104 Form to Explore New Applications

Besides fulfilling your tax filing obligations, the 1104 form can also spark creative ideas for new applications. For example:

- Tax-planning tool: Analyze your current financial situation and identify areas where you can optimize your tax strategy.

- Personal financial snapshot: Use the form to track your income, expenses, and tax liability over multiple years, providing insights into your financial journey.

- Educational resource: The 1104 form serves as a valuable learning tool to understand the Colorado tax system and personal finance principles.

Conclusion

The 1104 Colorado form is an essential tool for managing your tax obligations and making informed financial decisions. By understanding its components, avoiding common mistakes, and exploring its potential applications, you can navigate the tax filing process with confidence and accuracy.