Introduction

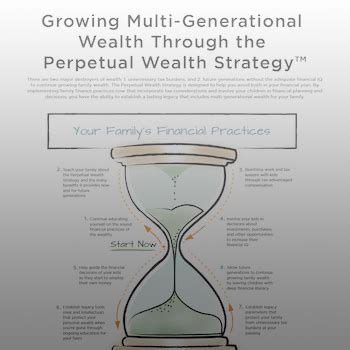

In a world where financial security is paramount, perpetual trust funds have emerged as a sophisticated tool to safeguard wealth and ensure its longevity for generations to come. By forming a legal entity that holds assets in perpetuity, individuals and families can establish a legacy that endures beyond their lifetimes. This article delves into the intricacies of perpetual trust funds, their benefits, and innovative applications.

Benefits of Perpetual Trust Funds

Asset Protection and Preservation

Perpetual trust funds provide unparalleled asset protection from external threats such as lawsuits, creditors, and financial mismanagement. Assets held in the trust are managed by independent trustees, who are legally bound to protect and preserve the trust’s assets for the benefit of the beneficiaries.

Multi-Generational Wealth Transfer

Unlike wills or other estate planning tools, perpetual trust funds can continue to exist and distribute assets across multiple generations. This ensures that wealth can be preserved and passed down to future heirs, without the risk of depletion or fragmentation.

Tax Minimization

Trusts can be structured to minimize taxes on capital gains, income, and estate taxes. By taking advantage of tax-exempt status and other tax-saving provisions, perpetual trust funds can significantly reduce the tax burden on beneficiaries.

Mechanics of Perpetual Trust Funds

Perpetual trust funds are typically established by a trust agreement or trust deed. This document outlines the terms of the trust, including the settlor (the person creating the trust), the beneficiaries, the assets to be held, and the powers of the trustees.

Role of Trustees

Trustees are the guardians of the trust’s assets and must act in the best interests of the beneficiaries. They are responsible for managing the assets, distributing income and principal, and ensuring that the terms of the trust are followed.

Investment Strategies

Perpetual trust funds can invest in a wide range of assets, including stocks, bonds, real estate, and private equity. The investment strategy is typically determined by the settlor and the trustees, and must adhere to the trust’s investment objectives and risk tolerance.

Motivations for Establishing Perpetual Trust Funds

Legacy Planning

Many individuals establish perpetual trust funds to create a lasting legacy for their families and future generations. They want to ensure that their wealth is preserved and used to support the education, health, and well-being of their loved ones.

Social Responsibility

Some individuals use perpetual trust funds to support charitable causes and social impact initiatives. By funding organizations that align with their values, they can leave a positive mark on society while preserving their wealth.

Tax Planning

Taxes can significantly erode wealth over time. Perpetual trust funds provide a tax-efficient way to transfer wealth to future generations and minimize the impact of estate and capital gains taxes.

Innovative Applications of Perpetual Trust Funds

Dynasty Trusts

Dynasty trusts are perpetual trusts designed to pass wealth down through multiple generations indefinitely. They can provide significant tax savings and ensure that assets remain in the family for as long as possible.

Charitable Remainder Trusts

Charitable remainder trusts allow donors to make a significant gift to charity while retaining a stream of income for a period of time. At the end of the trust term, the remaining assets are distributed to the charity.

Conservation Trusts

Conservation trusts are dedicated to protecting natural resources, historic landmarks, and other assets of ecological or cultural value. They use perpetual trust funds to acquire and manage these assets for the benefit of future generations.

Pain Points and Considerations

Complexities and Costs

Establishing and managing a perpetual trust fund can be complex and expensive. Legal fees, accounting expenses, and investment management costs can add up over time.

Potential for Mismanagement

If trustees are not properly selected or managed, there is a risk that the trust’s assets could be mismanaged or misappropriated.

Restrictions on Beneficiaries

Perpetual trust funds can place restrictions on beneficiaries, such as when they can receive distributions or how they can use the funds. This can lead to conflicts between beneficiaries and trustees.

Comparison of Perpetual Trust Funds and Other Estate Planning Tools

| Feature | Perpetual Trust Fund | Will | Revocable Living Trust |

|---|---|---|---|

| Asset Protection | Excellent | Moderate | Good |

| Multi-Generational Wealth Transfer | Yes | No | Limited |

| Tax Minimization | Good | Moderate | Good |

| Complexity and Costs | High | Moderate | Moderate |

| Flexibility | Moderate | High | High |

Pros and Cons of Perpetual Trust Funds

Pros

- Provides unparalleled asset protection and preservation.

- Ensures multi-generational wealth transfer and legacy planning.

- Minimizes taxes on capital gains, income, and estate assets.

- Can be used to support charitable causes and social impact initiatives.

Cons

- Complex and expensive to establish and manage.

- Can place restrictions on beneficiaries.

- Potential for mismanagement if trustees are not properly selected and managed.

Conclusion

Perpetual trust funds offer a unique and powerful tool for wealth preservation and multi-generational planning. They provide asset protection, minimize taxes, and ensure that wealth can be preserved and passed down to future generations. However, they also come with complexities and costs that must be considered. By carefully weighing the benefits and drawbacks, individuals and families can determine whether a perpetual trust fund is the right choice for their financial and legacy planning goals.

Additional Considerations

Table 1: Estimated Costs of Establishing and Managing a Perpetual Trust Fund

| Service | Cost Range |

|---|---|

| Legal Fees | $5,000 – $25,000 |

| Accounting Fees | $1,000 – $5,000 annually |

| Investment Management Fees | 0.5% – 1.5% of assets annually |

Table 2: Tax Savings from Perpetual Trust Funds

| Tax | Savings |

|---|---|

| Capital Gains Tax | Deferred or eliminated |

| Income Tax | Reduced or eliminated |

| Estate Tax | Reduced or eliminated |

Table 3: Types of Assets Held in Perpetual Trust Funds

| Asset Class | Example |

|---|---|

| Stocks | Apple, Google |

| Bonds | U.S. Treasury Bonds |

| Real Estate | Commercial properties, farmland |

| Private Equity | Venture capital funds, private equity funds |

| Commodities | Gold, oil |

Table 4: Motivations for Establishing Perpetual Trust Funds

| Motivation | Explanation |

|---|---|

| Legacy Planning | Preserving wealth for future generations |

| Social Responsibility | Supporting charitable causes and social impact initiatives |

| Tax Planning | Minimizing estate taxes and capital gains taxes |

| Risk Management | Protecting assets from lawsuits and creditors |