Navigating the Expense of Higher Education

Embarking on a higher education journey is a significant life decision that comes with substantial financial considerations. Northern State University (NSU), a renowned institution in South Dakota, offers a diverse range of academic programs that can equip you with the knowledge and skills to succeed in your chosen field. However, understanding the university’s tuition costs is crucial before making an informed decision about your future.

Unveiling the Tuition Landscape

For the 2022-2023 academic year, NSU sets the annual tuition rates as follows:

- In-state undergraduate tuition: $10,968

- Out-of-state undergraduate tuition: $17,940

- In-state graduate tuition: $13,402

- Out-of-state graduate tuition: $20,624

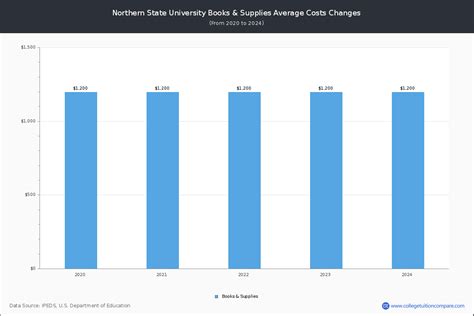

Exploring Additional Fees

Tuition is not the only expense associated with attending NSU. Students may incur additional costs such as:

- Student fees: $938 (per year)

- Technology fee: $288 (per year)

- Housing (on-campus): $4,300 – $7,200 (per academic year)

- Board (meal plan): $4,900 – $6,900 (per academic year)

- Transportation: Cost varies depending on individual circumstances

- Books and other supplies: $1,000 – $1,500 (per academic year)

Understanding Financial Aid Options

NSU recognizes the financial burden that higher education can impose and offers a range of financial aid options to support students pursuing their academic aspirations. These include:

- Scholarships: NSU offers over $4 million in scholarship funds annually based on academic merit, athletic performance, and other criteria.

- Grants: Grants, unlike loans, do not have to be repaid and are awarded based on financial need.

- Federal and State Loans: These loans provide financial assistance at low interest rates with flexible repayment plans.

- Work-Study Program: Students eligible for work-study can earn wages to offset educational expenses.

Planning for the Future

Planning for the financial aspects of higher education is essential to ensure a smooth and successful journey. Consider these tips:

- Estimate your total cost: Determine the approximate cost of tuition, fees, housing, and other expenses for the duration of your program.

- Explore financial aid options: Research and apply for scholarships, grants, and loans to reduce the financial burden.

- Create a budget: Track your income and expenses to manage your finances effectively.

- Consider part-time work or summer employment: Earning income outside of your studies can help supplement your financial resources.

- Communicate with the financial aid office: Seek guidance from university professionals who can assist you in navigating the financial aid process and exploring payment options.

Empowering Minds, Transforming Futures

NSU’s commitment to providing accessible and affordable higher education is unwavering. With its diverse academic offerings, financial aid support, and dedicated faculty, the university empowers students to pursue their academic dreams. Embark on your educational journey with confidence, knowing that NSU is invested in your success both inside and outside the classroom.

Frequently Asked Questions (FAQs)

Q1: What is the tuition rate for in-state undergraduate students at NSU?

A1: The annual tuition rate for in-state undergraduate students at NSU for the 2022-2023 academic year is $10,968.

Q2: Are there additional fees beyond tuition?

A2: Yes, students may incur additional fees such as student fees, technology fee, housing, board, transportation, and books.

Q3: What types of financial aid options are available at NSU?

A3: NSU offers scholarships, grants, federal and state loans, and work-study programs to support students financially.

Q4: How can I estimate the total cost of attendance at NSU?

A4: To estimate the total cost of attendance, consider tuition, fees, housing, board, transportation, books, and other expenses.

Q5: What is the best way to plan for the financial aspects of higher education?

A5: To plan effectively, estimate your total cost, explore financial aid options, create a budget, consider part-time work or summer employment, and communicate with the financial aid office.

Q6: How can I ensure that I am getting the most value for my tuition investment?

A6: Make the most of your tuition investment by actively participating in class, utilizing campus resources, pursuing extracurricular activities, and building relationships with faculty and staff.

Q7: Does NSU offer any special programs to help students afford college?

A7: Yes, NSU offers programs such as the Northern Access Program, which provides financial assistance to eligible students with financial need, and the Tuition Lock Promise, which allows incoming freshmen to lock in their tuition rate for four years.

Q8: What resources are available to help me make informed financial decisions about my education?

A8: NSU provides a dedicated financial aid office, counseling services, and online tools to assist students with financial planning and decision-making.