Introduction

Misericordia University, nestled in the heart of Pennsylvania, is a well-respected institution of higher learning that offers a wide range of undergraduate, graduate, and professional programs. While the university’s academic reputation is undeniable, it’s essential for prospective students to understand the associated costs to make informed decisions about their education. This comprehensive article will delve into the ins and outs of Misericordia University’s tuition, fees, and other expenses to help you navigate the financial landscape.

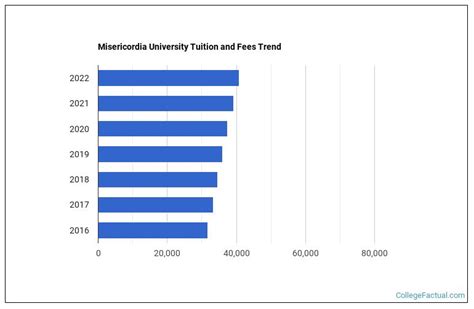

Understanding Tuition Costs

Tuition is the primary cost associated with attending Misericordia University. The amount you pay for tuition will vary depending on your program of study, year of enrollment, and residency status.

Undergraduate Tuition

- In-state undergraduates: $32,530 per academic year

- Out-of-state undergraduates: $36,930 per academic year

- Online undergraduate programs: $495 per credit hour

Graduate Tuition

- Graduate programs in education, health sciences, and natural sciences: $850 per credit hour

- Graduate programs in business and law: $945 per credit hour

- Doctor of Pharmacy program: $1,095 per credit hour

Professional Tuition

- Doctor of Physical Therapy program: $1,235 per credit hour

Fees

In addition to tuition, you will also be responsible for paying certain fees, including:

- Student activity fee: $595 per academic year

- Technology fee: $350 per academic year

- Facilities fee: $200 per academic year

- Health insurance fee (for students who do not have comparable coverage): $1,435 per academic year

Other Expenses

Beyond tuition and fees, you should also budget for other essential expenses, such as:

- Room and board: On-campus housing options range from $8,175 to $13,900 per academic year. Meal plans cost between $2,400 and $3,200 per academic year.

- Books and supplies: The average cost of books and supplies is $1,000 per academic year.

- Transportation: If you plan to commute, you will need to factor in the cost of gas, parking, or public transportation.

- Personal expenses: Miscellaneous expenses, such as clothing, entertainment, and laundry, can vary greatly depending on your lifestyle.

Financial Aid and Scholarships

Misericordia University offers a wide range of financial aid and scholarship opportunities to help students manage the cost of education. In the 2021-2022 academic year, over $110 million in financial aid was awarded to students.

- Federal Pell Grants: These grants are awarded to students with exceptional financial need who meet certain income criteria.

- Federal Supplemental Educational Opportunity Grants (FSEOG): These grants are awarded to students with exceptional financial need who demonstrate academic promise.

- Federal Work-Study Program: This program allows students to earn money to help pay for their educational expenses.

- University Scholarships: Misericordia University offers a variety of scholarships to students based on academic merit, athletic ability, and other factors.

Tips and Tricks for Reducing Costs

- Apply for financial aid: Don’t hesitate to apply for federal, state, and institutional financial aid.

- Consider part-time enrollment: If you have financial constraints, consider enrolling part-time while working to earn money.

- Negotiate with the university: If you have a strong academic record or extenuating circumstances, you may be able to negotiate a lower tuition rate.

- Share expenses with roommates: If you live on campus, share expenses with roommates to save money on housing and utilities.

- Take advantage of student discounts: Many local businesses offer discounts to students, so be sure to ask for them.

Common Mistakes to Avoid

- Underestimating the cost of attendance: Don’t assume that tuition is the only expense you will need to cover. Budget for all associated costs to avoid financial surprises.

- Not applying for financial aid: Don’t be deterred by the application process. Apply for all potential sources of financial assistance to reduce the burden of tuition costs.

- Borrowing too much student debt: Take on only as much student debt as you need and can comfortably repay after graduation.

- Ignoring your student loans: Pay back your student loans on time to avoid accruing interest and damaging your credit score.

- Spending carelessly: Be mindful of your spending habits and prioritize essential expenses over luxuries.

Pros and Cons

Pros:

- High-quality academic programs with experienced faculty

- Generous financial aid and scholarship opportunities

- Supportive student services and facilities

- Strong community involvement and networking opportunities

Cons:

- Higher tuition costs compared to some public universities

- Limited availability of on-campus housing

- Parking can be challenging on campus

- Relatively small student body size may limit social opportunities

Conclusion

Understanding the costs of attending Misericordia University is crucial for prospective students to make informed decisions about their education. While tuition is a significant expense, Misericordia University offers a range of financial aid and scholarship opportunities to help students manage the costs. By carefully budgeting for all expenses, applying for financial assistance, and avoiding common mistakes, students can navigate the financial landscape of higher education successfully. Misericordia University’s high-quality academic programs, supportive environment, and opportunities for personal growth make it a valuable investment in your future.