It’s a question that many people ask themselves when they’re in a relationship. After all, you want to be able to take care of your loved ones, and that includes making sure they have access to the healthcare they need.

So, can you use your FSA for your girlfriend? The answer is yes, but there are some important things to keep in mind.

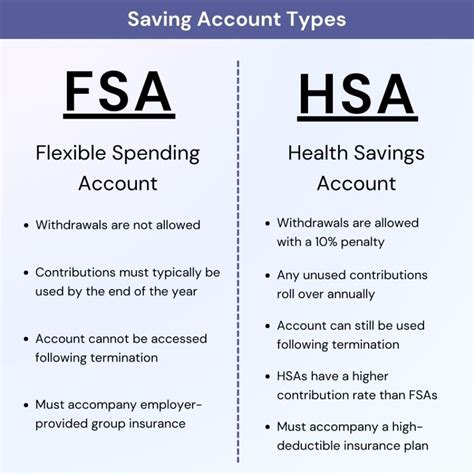

What is an FSA?

An FSA, or flexible spending account, is a type of savings account that allows you to set aside money on a pre-tax basis to pay for qualified medical expenses. This can include things like doctor’s visits, dental care, and prescription drugs.

Who is eligible for an FSA?

FSAs are available to employees who are enrolled in a group health plan offered by their employer. You must also meet certain eligibility requirements, such as having a minimum amount of income.

How do I use my FSA for my girlfriend?

To use your FSA for your girlfriend, you’ll need to add her to your FSA account as a dependent. Once she’s added, you’ll be able to use your FSA funds to pay for her qualified medical expenses.

What are the limits on FSA contributions?

The amount of money you can contribute to your FSA each year is limited by the IRS. For 2023, the limit is $3,050 for individuals and $6,150 for families.

What are the tax benefits of using an FSA?

FSAs offer several tax benefits. First, the money you contribute to your FSA is deducted from your paycheck on a pre-tax basis. This means that you won’t have to pay income tax on this money. Second, the money you withdraw from your FSA to pay for qualified medical expenses is also tax-free.

Are there any drawbacks to using an FSA?

There are a few potential drawbacks to using an FSA. First, you must use all of the money in your FSA by the end of the year. If you don’t, the money will be forfeited. Second, FSAs can be complex to administer. You’ll need to keep track of your expenses and make sure that you’re only using your FSA funds for qualified expenses.

Is an FSA right for me?

Whether or not an FSA is right for you depends on your individual circumstances. If you have a lot of qualified medical expenses, an FSA can be a great way to save money on taxes. However, if you’re not sure if you’ll be able to use all of the money in your FSA by the end of the year, you may want to consider other options, such as a health savings account (HSA).

Here are some additional things to keep in mind about using your FSA for your girlfriend:

- You can only use your FSA to pay for qualified medical expenses for your girlfriend if she is your legal dependent.

- You’ll need to provide documentation to your FSA provider that your girlfriend is your legal dependent. This documentation can include a birth certificate, a marriage certificate, or a court order.

- You’ll need to keep track of your FSA expenses and make sure that you’re only using your FSA funds for qualified expenses.

- If you use your FSA funds to pay for non-qualified expenses, you may have to pay taxes and penalties.

Conclusion

Using your FSA for your girlfriend can be a great way to save money on taxes. However, it’s important to understand the rules and regulations governing FSAs before you make a decision. If you have any questions, you should contact your FSA provider or a tax professional.